We believe that the best way to reach your customers is through their mobile devices. So for this month’s market research, we have profiled major insurer, Allstate, against two of its biggest competitors, Progressive and State Farm, to explore how mobile intelligence could inform opportunities for Allstate to competitively conquest customers from its two rivals.

According to the National Association of Insurance Commissioners, Allstate is the fifth-largest property casualty insurer in the United States, behind Progressive (fourth-largest) and State Farm (overall largest):

While these stats are unremarkable on their own, they become more interesting when you take into account mobile customer penetration for each of these companies. While Progressive has a similar market share to Allstate, it has been more successful at moving their customers to mobile channels, with 300%+ more mobile app users. And although State Farm has 2x the market share of these 2 insurance rivals, it only has 1.5x more mobile users than Allstate. Here is the data laid out in chart form.

Now that we know the mobile penetration numbers, let’s break them down into a few app user insights:

Here’s what the data tells us:

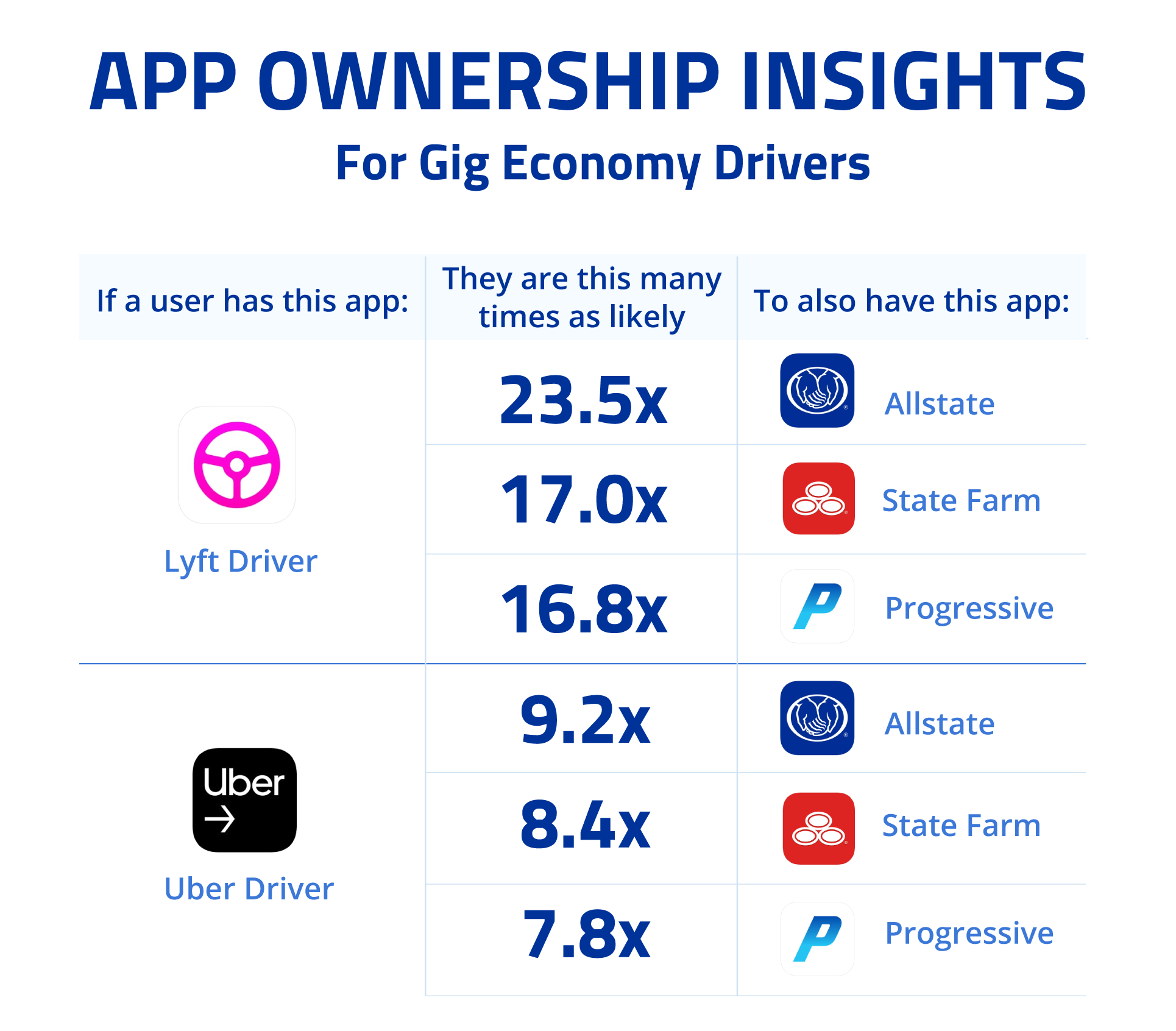

Despite having the least market share of these companies, Allstate appears to be the insurer of choice for gig economy drivers:

This could be due to Allstate’s competitively priced partnership protection plan for Uber drivers (covering the most states/regions as compared to State Farm); and since 2/3 of Uber drivers also drive for Lyft, this could account for the significant skew of both Uber and Lyft drivers’ likelihood to have the Allstate app.

Being able to effectively reach your mobile customers starts with having accurate data about who they are and if there’s any user overlap across competitors. So what can Allstate do with this data?

In addition, establishing partnerships with apps that index well across the board like Chewy, Applebee’s, and My Dish, might be an opportunity for all three insurance companies to expand their mobile market share.

By taking a look at the mobile data across these three apps, we were easily able to identify several distinct audiences, along with unique ways to reach them. And that’s just the beginning. With a TrueData Mobile Intelligence Report, you can learn who your customers are and how they engage with competitors, so that reaching them isn’t just about minimizing attrition, it’s about effective conquesting.

Understand Your Customers – and your Competitors – with TrueData Mobile Intelligence

Subscribe For Updates